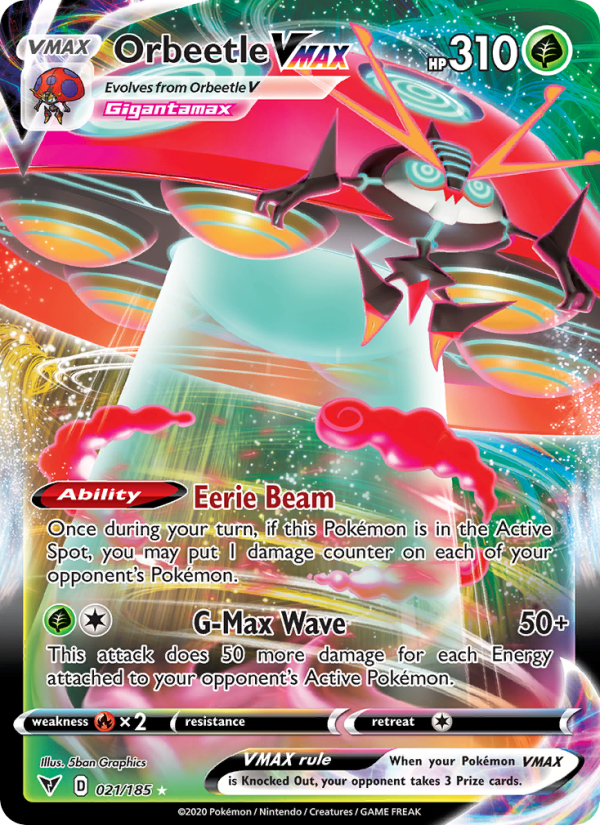

Image courtesy of TCGdex.net

Regional Price Landscape for Orbeetle VMAX Across Markets

In the Pokémon TCG ecosystem, some cards seem to travel with the wind—appearing in one region with excitement, then lagging behind in another as shops jockey for stock. Orbeetle VMAX, a holo Rare VMAX from the Vivid Voltage era, provides a crisp lens into how market forces shape value across regions. With a towering 310 HP and a Grass type, this card isn’t just a fearsome battler in the Meta; it’s a beacon for collectors and players watching regional supply dynamics. The illustration by 5ban Graphics captures the card’s dramatic confrontation, and the card’s evolutive line—from Orbeetle V to Orbeetle VMAX—adds another layer to its appeal. ⚡🔥 To understand why prices diverge by geography, it helps to sketch the card’s core mechanics. Orbeetle VMAX leverages Eerie Beam, an ability that can nudge the turning tide by placing a damage counter on each of the opponent’s Pokémon once per turn when the card sits in the Active Spot. Its main punch, G-Max Wave, scales with the opponent’s Active Energy, starting at a baseline of 50 damage and climbing as opponents add energy to their frontline. A Fire weakness (x2) makes matchup considerations part of the price story—regions with more Fire-heavy lineups or with larger tournament footprints may see sharper demand for counter-picks. And with a Retreat Cost of 1 and a positioning in the Expanded format under Regulation Mark D, Orbeetle VMAX remains a stalwart option for collectors and players who track both playability and rarity. Let’s dive into the numbers that reveal regional behavior. CardMarket (EUR) provides a revealing snapshot for holo copies. The official average sits around 2.05 EUR, with a low around 0.79 EUR, signaling that bargain listings exist even as premium copies circulate. The multi-day trend reads around 1.76, suggesting a modest but steady drift upwards in some European markets. For holo-specific data, CardMarket shows notable upside signals: a holo trend value near 3.39, with short-term averages (avg1-holo, avg7-holo, avg30-holo) climbing to roughly 3.65–3.99 EUR. In other words, the holo version in Europe has shown resilience and rising interest among collectors, a testament to the card’s visual appeal and its enduring utility in certain deck archetypes. Across the Atlantic, the US market presents a more varied picture via TCGPlayer data. The holo price spectrum is broad: the low price can dip to about $0.75, while the high price can spike to $11.20 for standout listings. The market price hovers around $1.48, with a direct-low-price around $1.46. This wider dispersion reflects ongoing supply chain realities—as sellers in different regions source stock, some listings are driven by immediate demand, others by long-tail collector interest. The takeaway is clear: in the US market, Orbeetle VMAX holo can be both an accessible pickup for gameplay-minded players and a potential premium target for serious collectors depending on listing quality and condition. Beyond raw numbers, the regional story is shaped by distribution, currency flow, and timing. European and North American markets often diverge due to print runs, restocks, local tax structures, and shipping timelines. In practice, a player in one country might find a competitive price on TCGPlayer while a European buyer encounters a similar figure only after a few weeks of market movement. For holo copies, the premium seen in CardMarket’s holo metrics reflects a blend of collector demand and perceived scarcity in certain European channels, where the card remains a visually striking centerpiece on many display shelves. From a gameplay lens, this regional price choreography has practical implications. For new players building budgets, awareness of regional price strength can guide decisions about whether to buy raw or hold out for a sale. For collectors, price variability can signal opportunities to snag a pristine holo at a favorable rate when regional fluctuations align with a lull in listings. And for traders aiming to optimize portfolios, observing the interplay of CardMarket’s EUR signals and TCGPlayer’s USD spread provides a richer sense of market momentum than a single source could offer. The card’s high HP, robust attack, and the strategic twist of Eerie Beam mean it remains a staple in discussions about value retention across formats and eras. 🎮🎴 Strategically, matching regional insights with personal goals matters. If your priority is gameplay utility, a mid-range holo from a stable market might deliver steadier playability without an outsized price tag. If you’re chasing a collector’s crown, watching holo-specific metrics—like the CardMarket holo trend and the broad USD spread—can help you time acquisitions around dips or surges. And because Orbeetle VMAX hails from the Vivid Voltage era, it also benefits from reprint cycles and rotation schedules that subtly shift supply injections across markets. The result is a dynamic, living price story that rewards patient, informed decisions. As you explore these price signals, you’ll likely notice a synergy between product context and market reality. The card’s breathtaking art, illustrated by 5ban Graphics, enhances its shelf presence and elevates its desirability beyond mere stat lines. This is a card that looks as dramatic as its G-Max Wave is potent, a combination that helps explain why certain regions exhibit stronger holo demand at any given moment. The prices you observe are not just numbers—they’re a reflection of regional tastes, supply quirks, and the enduring love fans bring to the table when Orbeetle bursts onto the battlefield. Polycarbonate Card Holder & Phone Case with MagSafeMore from our network

- Portal Mage: Art Direction and Visual Composition in Magic: The Gathering

- Mass Estimates Reshape Stellar Evolution for a Cygnus Blue Giant

- Knightfisher: Through Time—Evolution of MTG Card Frames

- How Social Dynamics Drive Impatience in MTG Popularity

- Tracking Linvala, Keeper of Silence’s Value Through Reprint Cycles